free cash flow yield private equity

Free Cash Flow and CAPEX. Free Cash Flow Help.

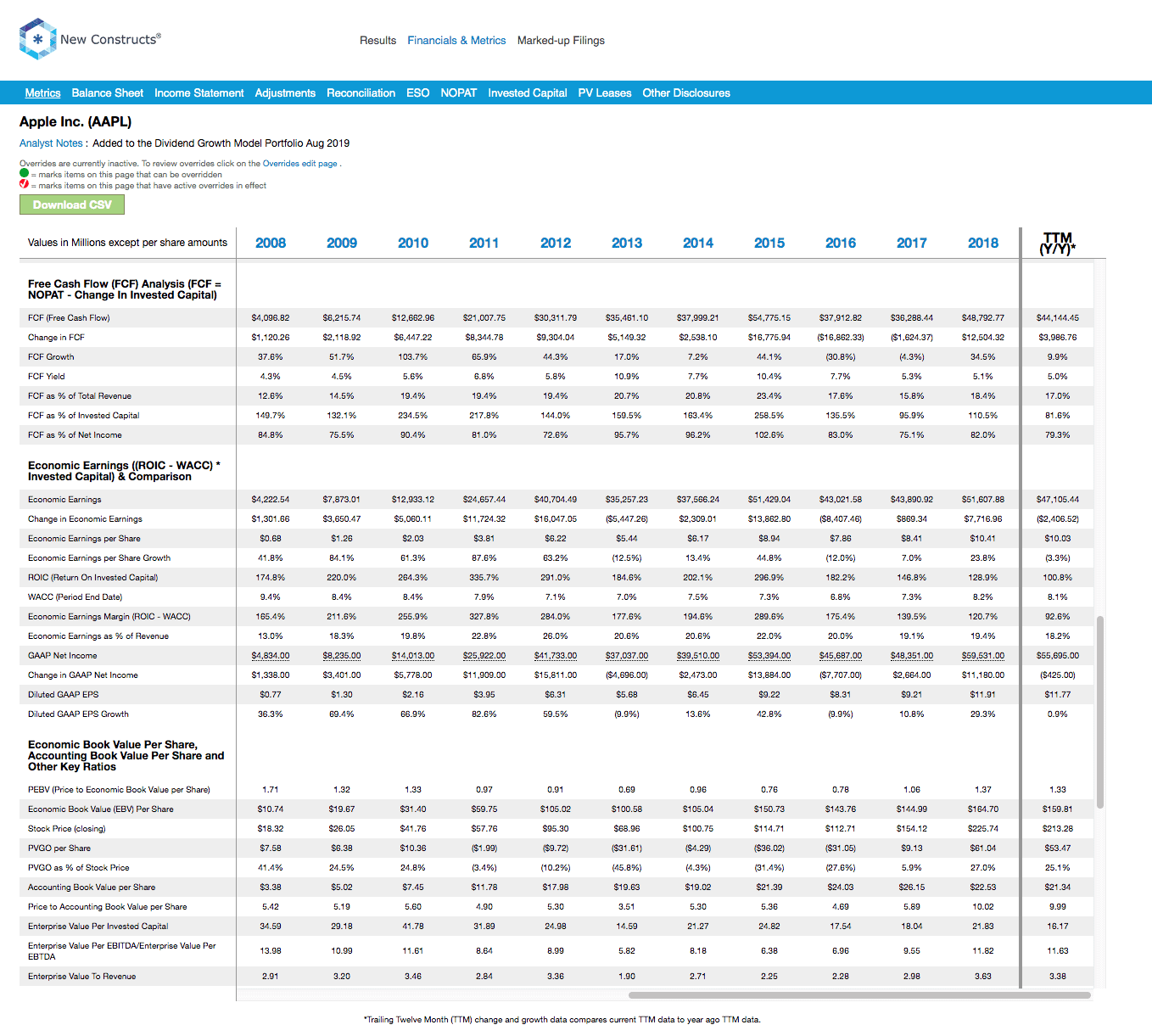

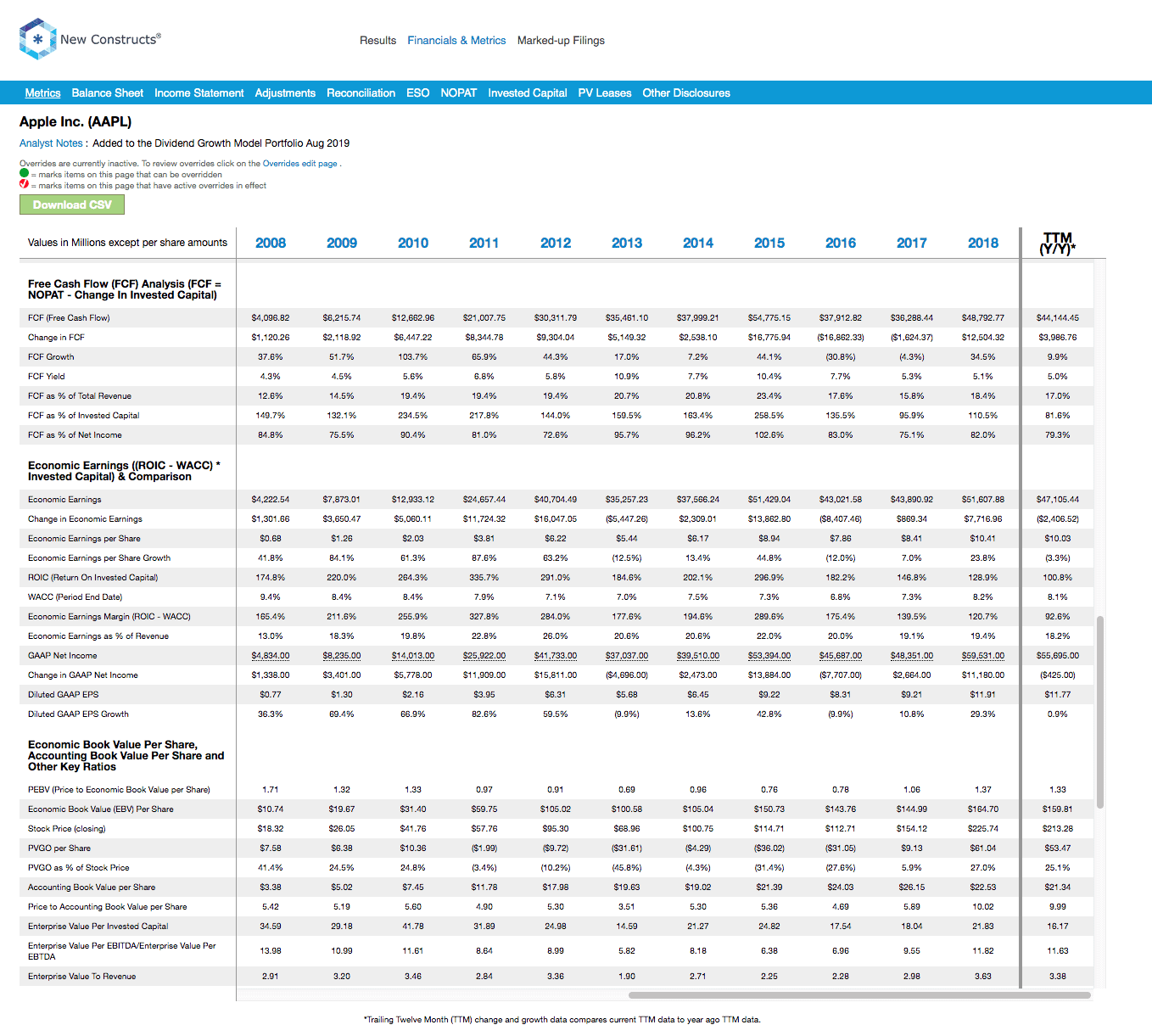

Education Metrics Fcf New Constructs

After all EquityMultiples investment offerings span the capital stack and a range.

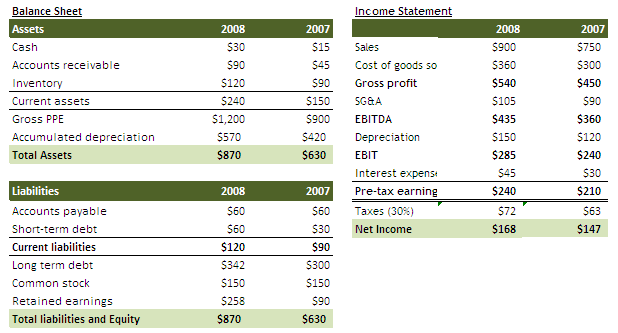

. This article examines the practicalities and limitations of three common real estate return metrics. For FCFE however we begin with net income a metric that has already accounted for the interest expense and tax savings from any debt outstanding. Sponsor-to-sponsor deals held up well and initial public offerings increased by 121 to 81 billion as public equity markets soared.

Discounting free cash flows to firm FCFF at the weighted average cost of capital WACC yields the enterprise value. We have assumed this growth rate to be 3 in our model. By Analyst 2 in IB - Ind.

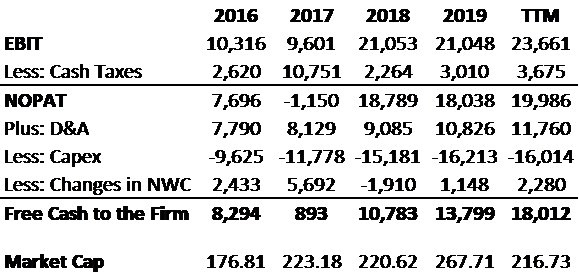

Free Cash Flow Yield Free Cash Flow Market Capitalization This ratio expresses the percentage of money left over for shareholders compared to the price of the stock. The Pacer Global Cash Cows Dividend ETF GCOW uses a free cash flow yield screen and a dividend yield screen to invest in 100 companies from the FTSE Developed Large-Cap Index. Levered free cash flow is the amount of cash that a company has remaining after accounting for payments to settle financial obligations short and long term including principal repayments.

The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided. Free Cash Flow to Equity FCFE Formula Net Income FCFE The calculation of FCFF begins with NOPAT which is a capital-structure neutral metric. The ratio is exceedingly pertinant to an investor because it relates to the value you are receiving for your investment dollar.

Investors perceive businesses with positive LFCF as financially healthy. It is also referred to as levered cash flow and abbreviated as LFCF. Like typical private equity funds such funds are usually structured as Limited Partnerships.

Equity free cash-flow yield Equity free cash-flow is the cash generated each year for shareholders after certain non-discretionary expenses have. FCFE is discounted at the cost of equity to value a companys equity. Heres the fun part.

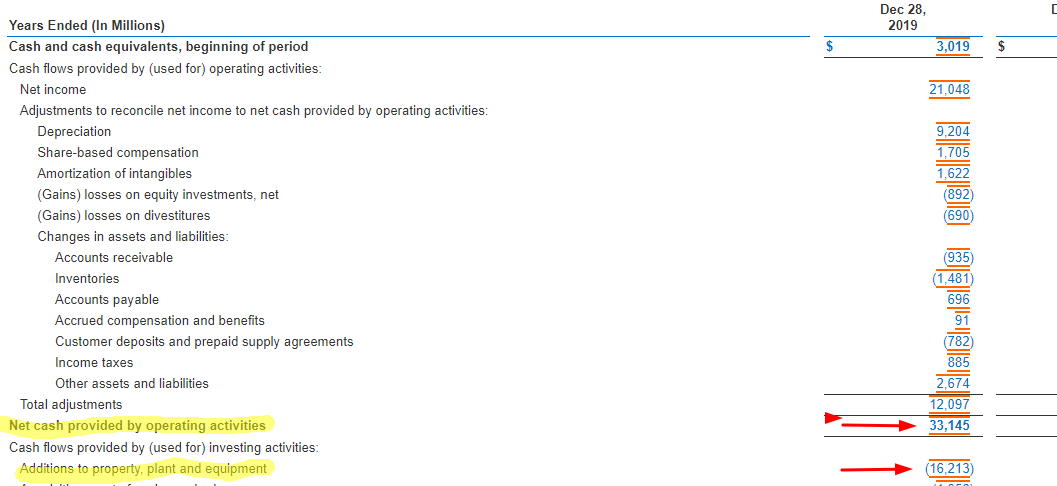

33 billion Free cash flow yield. One or multiple of these return metrics may be useful as you do your own diligence. To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital.

283 billion Free cash flow TTM. If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share. Advanced Emissions Solutions NASDAQ.

Once you calculate the Terminal Value find the present value of the Terminal Value. The firms net debt and the value of other claims are then subtracted from EV to calculate the equity value. The formula for Terminal value using Free Cash Flow to Equity is FCFF 2022 x 1growth Keg The growth rate is the perpetuity growth of Free Cash Flow to Equity.

This provides a more direct way. Exit count declined in 2020 but value was in line with the five-year average thanks partly to IPO growth. Of those using discounted free cash flow models FCFF models are.

To the Free Cash Flow Hypothesis a high level of debt has a disciplinary effect on managers and prevents. ADES is a small-cap stock 201 million market cap that has a very high dividend yield 928 and an even higher FCF yield 165. FCFY Free Cash Flow to Equity FCFE per shareMarket Price per share.

Levered FCF Yield Free Cash Flow to Equity Equity Value Alternatively the levered FCF yield can be calculated as the free cash flow on a per-share basis divided by the current share price. The fund manager called General Partner collects money from investors the Limited Partners and invests it in portfolio companies. EBITDA vs Free Cash Flow.

COWZs free cash flow yield of 4 is double IUSV and SPY at 2. Free cash flow to equity is one of the two definitions of free cash flow. Since high dividends do not always mean quality or consistent dividends GCOW uses a high free cash flow yield to screen for sustainable dividend yield.

What is Leveraged Finance. The formula shown below is just a derivation of the formula above as the only difference is that both the numerator and denominator were divided by the total number of shares outstanding. Cash-on-cash return equity multiple and internal rate of return or IRR.

By Prospect in IB-MA. Free Cash Flow to Equity FCFE is the amount of cash generated by a company that can be potentially How to Calculate FCFE from EBITDA How to Calculate FCFE from EBITDA You can calculate FCFE from EBITDA by subtracting interest taxes change in net working capital and capital expenditures and then add. Thats 2 the same as the bond.

When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model. Once again strategic buyers provided the largest exit channel. From the perspective of common equity holders the free cash flow yield calculation is as follows.

The price to economic book value PEBV ratio for COWZ is 14 which is less than the 18 for IUSV holdings and nearly half the 2. Free cash flow yield is really just the companys free cash flow divided by its market value. Free cash flow to equity FCFE is the cash flow available for distribution to a companys equity-holders.

The other being the free cash. Why Private Equity. 120 The cancellations combined with the impact of the government shutdown and weakness in.

Free Cash Flow Yield Free Cash Flow Market Capitalization This ratio expresses the percentage of money left over for shareholders compared to the price of the stock. It equals free cash flow to firm minus after-tax interest expense plus net increase in debt. It aims to provide a continuous stream.

If only the free cash flows to equity FCFE are discounted then the relevant discount rate should be the required return on equity.

Fcf Yield Unlevered Vs Levered Formula And Calculator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Explained

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Fcf Yield Unlevered Vs Levered Formula And Calculator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Education Metrics Fcf New Constructs

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth